Government Moves to Cut Circular Debt in Power Sector by Over Rs. 1.8 Trillion

In a significant development for Pakistan’s energy sector, the federal government is set to reduce the power sector’s circular debt from Rs. 2.381 trillion to approximately Rs. 561 billion. This reduction will be made possible through the disbursement of Rs. 1,275 billion, secured via loans from 18 commercial banks with approval from the International Monetary Fund (IMF).

According to reports, the funds are expected to be released this week or next. The Central Power Purchase Agency-G (CPPA-G) will utilize this amount to:

-

Fully clear Rs. 683 billion in liabilities of Power Holding Limited (PHL)

-

Settle Rs. 569 billion in interest-bearing dues owed to independent power producers (IPPs)

Once these payments are processed, the updated circular debt figures will be officially published on the Power Division’s website.

Key Measures Already Taken

-

Rs. 387 billion in Late Payment Interest (LPI) has been waived by IPPs, thanks to efforts from the government’s Task Force on Power Sector

-

Rs. 348 billion in arrears were previously settled:

-

Rs. 127 billion through budgetary support

-

Rs. 221 billion by CPPA-G

-

Despite these payments, a residual Rs. 561 billion will remain:

-

Rs. 224 billion in non-interest-bearing liabilities

-

Rs. 337 billion in interest-bearing dues

Consumer Impact

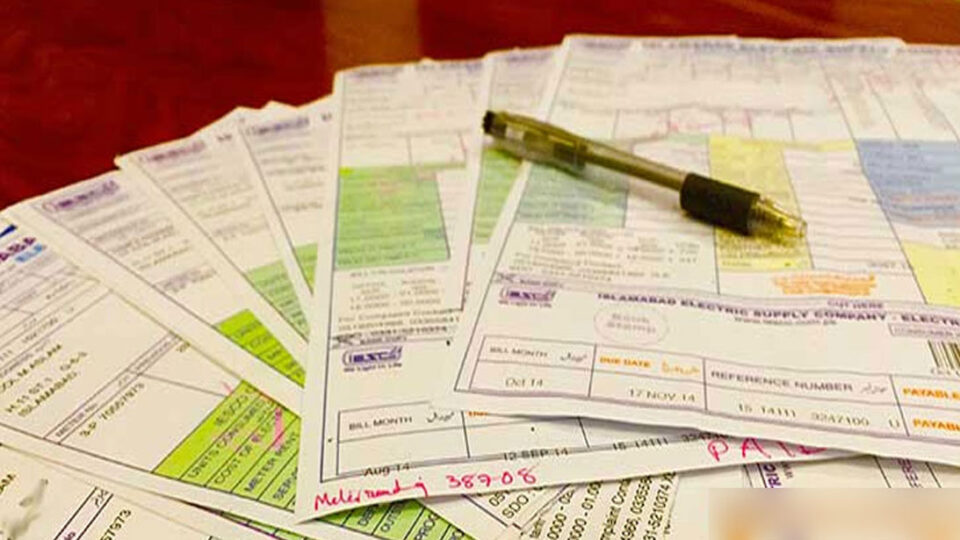

To repay the Rs. 1,275 billion loan, the existing Debt Service Surcharge (DSS) of Rs. 3.23 per unit will continue to be applied to electricity bills for the next six years. This surcharge was already in place and is not a new addition. However, a previous 10% cap on the surcharge has now been removed in compliance with IMF guidelines.